We've already got that; how would your system be different than the current system in place?Also, I'm not promoting the cap nor do I promote a tax on existing wealth. I'm for a progressive tax that will take from the income, not the base wealth.

-

Welcome to Religious Forums, a friendly forum to discuss all religions in a friendly surrounding.

Your voice is missing! You will need to register to get access to the following site features:- Reply to discussions and create your own threads.

- Our modern chat room. No add-ons or extensions required, just login and start chatting!

- Access to private conversations with other members.

We hope to see you as a part of our community soon!

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

Wealth acquisition and distribution?

- Thread starter Mock Turtle

- Start date

Do you imagine that there might be anyBy redistributing the wealth from the top to the bottom, e.g. by lowering taxes of the less fortunate.

unintended deleterious consequences?

Heyo

Veteran Member

It would take taxes from the rich, not the poor.We've already got that; how would your system be different than the current system in place?

Heyo

Veteran Member

Of course there will be consequences, The rich, until now, had the privilege to not pay (much) taxes.Do you imagine that there might be any

unintended deleterious consequences?

And, as we know, removing privileges feel like oppression.

I notice that you didn't address "deleterious".Of course there will be consequences, The rich, until now, had the privilege to not pay (much) taxes.

And, as we know, removing privileges feel like oppression.

Does this mean you think there will be only

positive consequences?

By redistributing the wealth from the top to the bottom, e.g. by lowering taxes of the less fortunate.

The less fortunate do not pay income tax in the US. Not sure how it works elsewhere..

Well I suppose it depends on who you feel qualifies as being less fortunate.

siti

Well-Known Member

The least fortunate don't pay tax on income, they either have none or earn too little to reach the tax threshold. And they are quite a large number - about 72 million households in the US...By redistributing the wealth from the top to the bottom, e.g. by lowering taxes of the less fortunate.

So if you took, say, $1 billion each from 1000 of the wealthiest people and redistributed it between the 72 million households that earn too little to pay tax, they'd get an average of about $14,000 each - do you reckon that trillion dollars would be reinvested?

Last edited:

Heyo

Veteran Member

Do you think the wealthy will take it lying down? I suspect much backlash by paid chills - and of course the fanboys.I notice that you didn't address "deleterious".

Does this mean you think there will be only

positive consequences?

Heyo

Veteran Member

They still pay VAT.The less fortunate do not pay income tax in the US. Not sure how it works elsewhere..

The 99%.Well I suppose it depends on who you feel qualifies as being less fortunate.

Heyo

Veteran Member

Yes. You forgot the corporations. The money isn't re-invested in the stock market, but it is re-invested in consumption, which shows up at the bottom line. The corporation could pay dividends on the revenue - or they can re-invest.The least fortunate don't pay tax on income, they either have none or earn too little to reach the tax threshold. And they are quite a large number - about 72 million households in the US...

So if you took, say, $1 billion each from 1000 of the wealthiest people and redistributed it between the 72 million households that earn too little to pay tax, they'd get an average of about $14,000 each - do you reckon that trillion dollars would be reinvested?

When taxes on capital gain are higher, as high as income taxes, investors (mostly the rich) would opt to get reasonable dividends.

siti

Well-Known Member

So effectively a trillion dollars transferred from investment portfolios to consumer spending...you don't think that might be a tad inflationary?Yes. You forgot the corporations. The money isn't re-invested in the stock market, but it is re-invested in consumption, which shows up at the bottom line. The corporation could pay dividends on the revenue - or they can re-invest.

When taxes on capital gain are higher, as high as income taxes, investors (mostly the rich) would opt to get reasonable dividends.

Heyo

Veteran Member

Yes, it is inflationary, or rather it would make the inflation visible. I'm of the opinion that we have an inflation, just not a runaway inflation. There is too much money (which is inflation), but it is in the hand of the super rich, who don't spend it. Instead, they are looking desperately for options to invest. Investments with low risk and high revenue, that is, because more money is their only goal for investments.So effectively a trillion dollars transferred from investment portfolios to consumer spending...you don't think that might be a tad inflationary?

PureX

Veteran Member

Those aren't pensions. There are no secure pensions, anymore. Those are investment schemes pretending to be pensions. They help to pump up the stock markets so the rich can get richer from the inflated stocks. And so they no longer have to provide any actual pensions for their employees.Correct me it I am wrong, but wouldn't you be taking money away from union pension funds if you take business profit over a certain value? Aren't those profits paid out as dividends to shareholders, many of whom participate through personal IRA's, self employed IRA's, and 401k's in addition to union pension funds?

Last edited:

Your question doesn't answer my question.Do you think the wealthy will take it lying down? I suspect much backlash by paid chills - and of course the fanboys.

I recall that decades ago, liberals greatly increased

the tax on yachts. After all, anyone who could afford

one should pay more tax, right? What could go wrong?

The effect was to kill many yacht building jobs of

blue collar workers.

The best ideas are great when hastily put down

on paper, but can have unintended consequences

that make even liberals scream "Ooopsie poopsie!"

I recommend the podcast Freakonomics to anyone

interested in the histories of public policies & their

consequences. Fascinating stuff, eg, the causal

link between abortion restriction & increased crime.

Koldo

Outstanding Member

Your question doesn't answer my question.

I recall that decades ago, liberals greatly increased

the tax on yachts. After all, anyone who could afford

one should pay more tax, right? What could go wrong?

The effect was to kill many yacht building jobs of

blue collar workers.

The best ideas are great when hastily put down

on paper, but can have unintended consequences

that make even liberals scream "Ooopsie poopsie!"

I recommend the podcast Freakonomics to anyone

interested in the histories of public policies & their

consequences. Fascinating stuff, eg, the causal

link between abortion restriction & increased crime.

Did the sum of money taxed still increase significantly in the long-term though? Did most of those workers eventually find similar paying jobs? The number of jobs killed in the short-term is not necessarily a problem depending on those two factors.

I don't know.Did the sum of money taxed still increase significantly in the long-term though?

But I'll bet the workers who lost their

jobs weren't concerned with tax revenue.

Unknown.Did most of those workers eventually find similar paying jobs?

If one proposes policy changes based solelyThe number of jobs killed in the short-term is not necessarily a problem depending on those two factors.

upon the wonderful results one imagines,

without considering the costs, one will

get bad policies.

Koldo

Outstanding Member

I don't know.

But I'll bet the workers who lost their

jobs weren't concerned with tax revenue.

Everyone tends to be worried first and foremost about how themselves will be personally affected by policy changes, regardless of whether the collective will benefit more from it.

Unknown.

If one proposes policy changes based solely

upon the wonderful results one imagines,

without considering the costs, one will

get bad policies.

Thus why it is important to hear all perspectives before making the decision to enact a significant change.

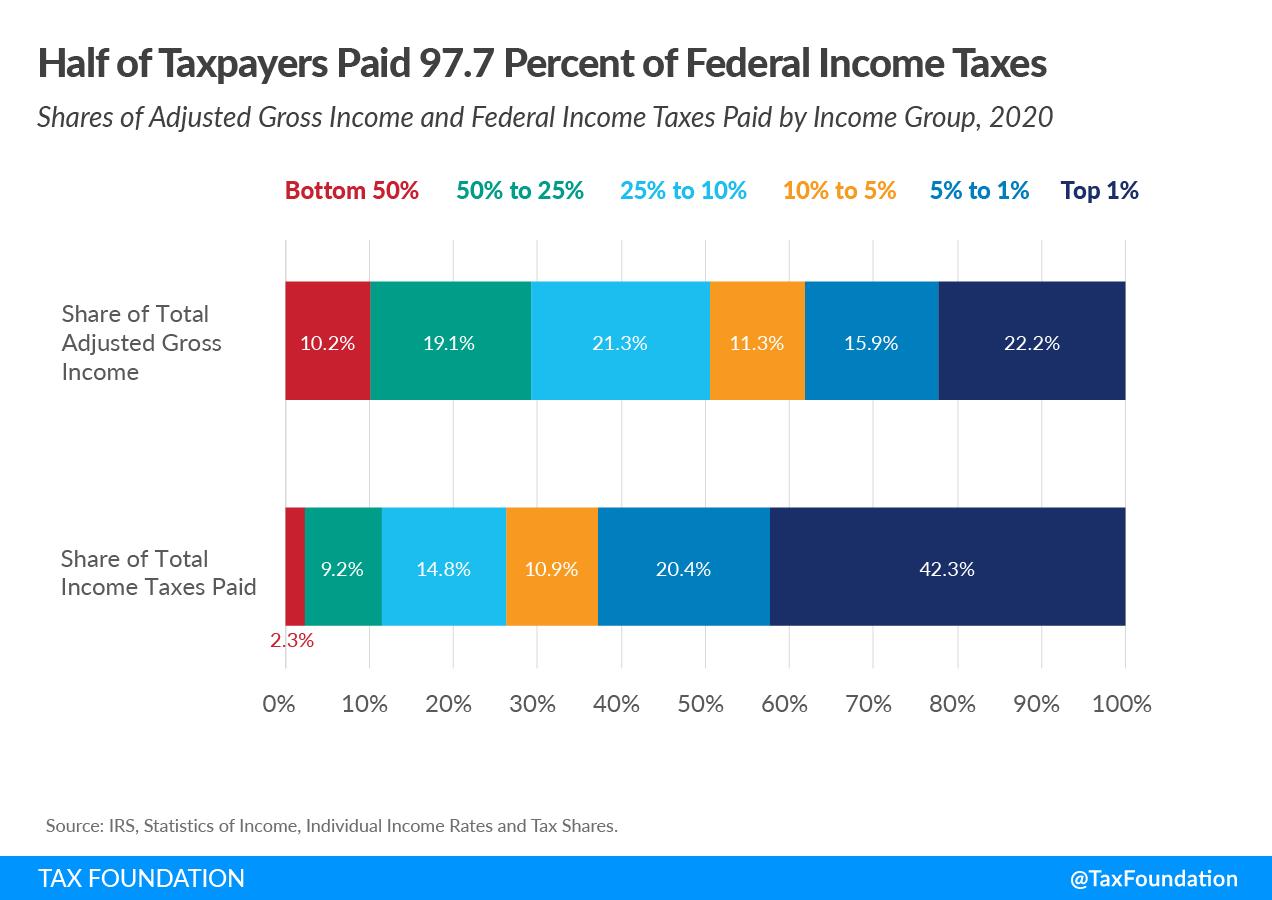

We already have that. The poor don't pay taxes; remember? (top 1% pays 42%, bottom 50% pays 2%)It would take taxes from the rich, not the poor.

Summary of the Latest Federal Income Tax Data, 2023 Update

The latest IRS data shows that the U.S. federal individual income tax continued to be progressive, borne primarily by the highest income earners.

Last edited:

They still pay VAT.

Does the VAT dramatically affect spending power for lower income individuals?

The 99%.

Well, that certainly is quite a low bar to qualify as one of the less fortunate. Sure, in literal terms, anyone with $1 or 1 Euro less than another can be said to have less fortune. In common usage though, do we truly consider someone in the middle and upper middle class as being one of the less fortunate? I, for one, do not.

Yes, the poor & middle class are obsessedEveryone tends to be worried first and foremost about how themselves will be personally affected by policy changes, regardless of whether the collective will benefit more from it.

with having good jobs. And they complain

when government kills jobs. So selfish.

It would also help to examine what happenedThus why it is important to hear all perspectives before making the decision to enact a significant change.

in other places when a proposed policy had

been adopted, eg, nationalizing all industries,

confiscating wealth.