I remember reading that Bhutan had few government social stability programs for this reason exactly. They'd never been needed, because the 'haves' tended to help the 'have nots' without any authority requiring them to do so. It was just part of the culture.I've always felt, although it might be unrealistic idealism, that the rich should be distributing their wealth via their own conscience, on their own volition, in wise philanthropy and charity. In some ancient monarchies, the king provided for his subjects. Lots of rich people are already doing that.

-

Welcome to Religious Forums, a friendly forum to discuss all religions in a friendly surrounding.

Your voice is missing! You will need to register to get access to the following site features:- Reply to discussions and create your own threads.

- Our modern chat room. No add-ons or extensions required, just login and start chatting!

- Access to private conversations with other members.

We hope to see you as a part of our community soon!

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

Wealth acquisition and distribution?

- Thread starter Mock Turtle

- Start date

The problem with expecting the haves to help the have not's outta the goodness of their hearts is...... if you make financial choices in a way that does not meet my approval, then come to me with your hand out when you're broke; I'm gonna be reluctant to give you some of my money so you can make more financial choices that does not meet my approval.I remember reading that Bhutan had few government social stability programs for this reason exactly. They'd never been needed, because the 'haves' tended to help the 'have nots' without any authority requiring them to do so. It was just part of the culture.

"expecting"The problem with expecting the haves to help the have not's outta the goodness of their hearts is...... if you make financial choices in a way that does not meet my approval, then come to me with your hand out when you're broke; I'm gonna be reluctant to give you some of my money so you can make more financial choices that does not meet my approval.

People can do things without being expected to do them.

People can have problems and not expect help.

Its worth noting the example given isn't part of our culture.

Now wouldn't that be nice. In some smaller tribal cultures it's still practiced, where everyone just naturally sees the needs of the group over themselves. In Mauritius there was a remnant of it. If you had extra fruit on your trees, you just set it out on the stone fence (which are all over) by your property or the road, and that's the unwritten law that it's for anyone who happens along to take. Free mangoes, yay!I remember reading that Bhutan had few government social stability programs for this reason exactly. They'd never been needed, because the 'haves' tended to help the 'have nots' without any authority requiring them to do so. It was just part of the culture.

It's still a monarchy, if I'm not mistaken. I think 'small' does better in this regard. I'm reminded of pioneer beef rings, where a dozen farmers or so shared in the butchering of an animal when needed, and took turns.I remember reading that Bhutan had few government social stability programs for this reason exactly. They'd never been needed, because the 'haves' tended to help the 'have nots' without any authority requiring them to do so. It was just part of the culture.

Heyo

Veteran Member

In Germany, it was part of the culture with a little help from the law.Yet, if corruption and bribery does not impact all countries equally or to the same extent, that should leave us asking why, don't you think?

Officers are employed for life with a generous pension. Bribery is one of the crimes which leads to automatic termination. So, only very boring and strict people went onto that career path. Payment isn't as high as in the industry, but the job is secure.

These people are who got us the stereotype of being very strict and humorless. And it was true, in a way.

But times have changed. People from all over Europe and from Turkey came to work here. Most adapted to our way of life, but we also assimilated a bit of their lifestyle. We are much more fun and laid back than in the past. We don't see everything as strict - and that also means we don't take laws and regulations as serious.

Also, we don't have as many officers. Many jobs are now done by employees who have just normal work contracts.

I still would advise against trying to bribe a German officer, but there are some who know the meaning of the word baksheesh.

Heyo

Veteran Member

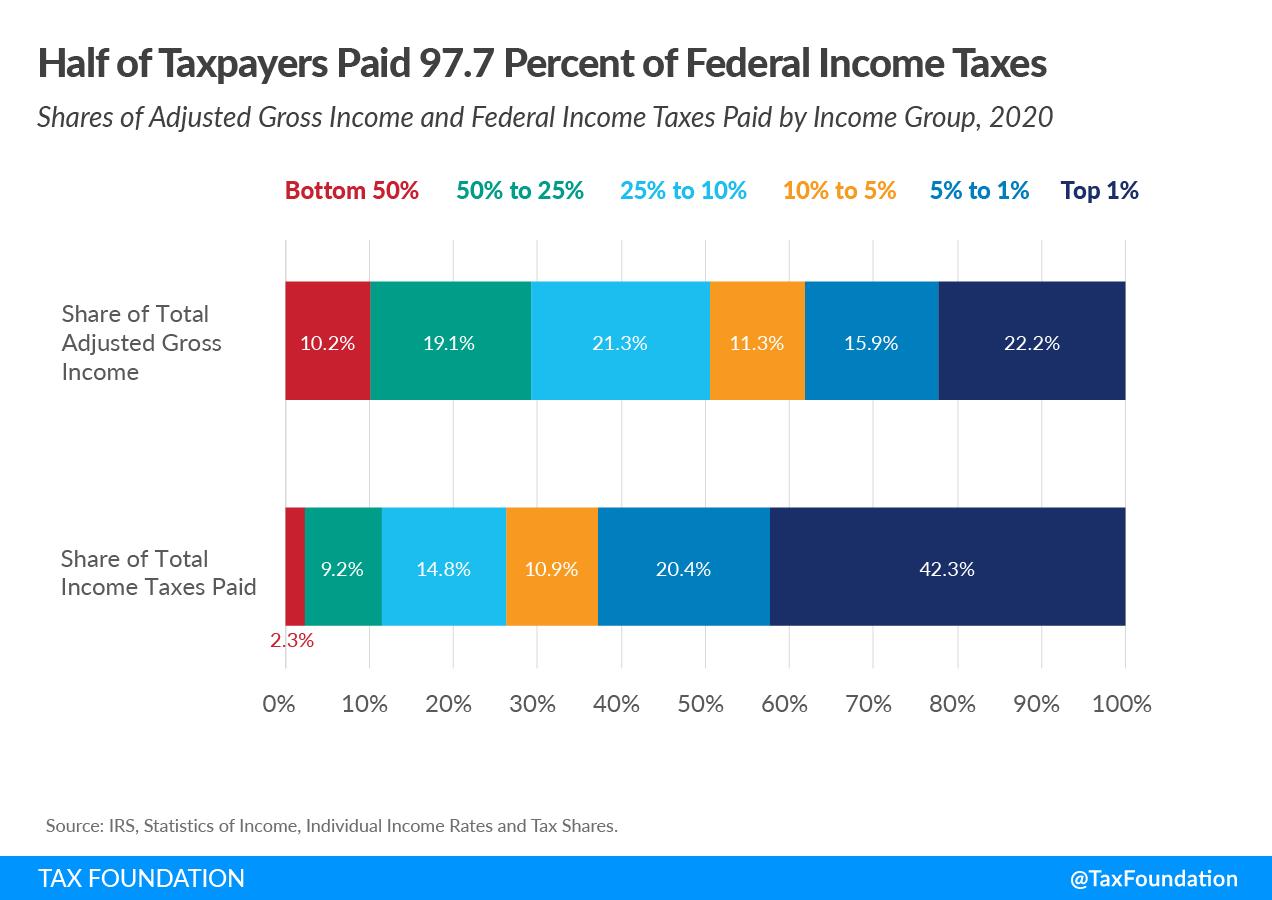

Something doesn't add up, if your numbers are right, and it is a fact (as we have agreed) that the rich got richer and the rest have stagnated.Perhaps your disagreement is based on false information, because if we use your standard that the 1960 model was fair, that would mean today the rich are paying far too much and the poor need to start paying more. According to the Tax Foundation, the top 1% made up only 22% of income but paid 42% of taxes. The bottom 50% made up 10% of all income, but only paid 2% of all taxes.

Summary of the Latest Federal Income Tax Data, 2023 Update

The latest IRS data shows that the U.S. federal individual income tax continued to be progressive, borne primarily by the highest income earners.taxfoundation.org

I think it may have to do with what your source sees as "income":

Bond interest, net imputed rental income, and others. I assume "others" includes dividends and other capital gain. If you exclude the income which makes up the biggest part of a capitalist income, you have to get to skewed numbers.AGI is a fairly narrow income concept and does not include income items like government transfers (except for the portion of Social Security benefits that is taxed), the value of employer-provided health insurance, underreported or unreported income (most notably that of sole proprietors), income derived from municipal bond interest, net imputed rental income, and others.

In Germany, it was part of the culture with a little help from the law.

Officers are employed for life with a generous pension. Bribery is one of the crimes which leads to automatic termination. So, only very boring and strict people went onto that career path. Payment isn't as high as in the industry, but the job is secure.

These people are who got us the stereotype of being very strict and humorless. And it was true, in a way.

But times have changed. People from all over Europe and from Turkey came to work here. Most adapted to our way of life, but we also assimilated a bit of their lifestyle. We are much more fun and laid back than in the past. We don't see everything as strict - and that also means we don't take laws and regulations as serious.

Also, we don't have as many officers. Many jobs are now done by employees who have just normal work contracts.

I still would advise against trying to bribe a German officer, but there are some who know the meaning of the word baksheesh.

How interesting! The stereotype of the stolid, humorless German was certainly part of my growing up. I had no idea as to the source of the stereotype.

Of course, the few Germans that I've actually known in the US have been rather happy and fun-loving, not fitting the stereotype in the least.

So you think E, Jean Carroll should have $33,000,000 of her award against Trump confiscated as a tax.So far I see no justification whatever from anyone why we shouldn't maintain a progressive tax on individual assets that eventually increases to 100% on let's say $50 million.

So you think E, Jean Carroll should have $33,000,000 of her award against Trump confiscated as a tax.

With the top tax bracket at 37% Fed Tax she is already down to $52.3 million. She also might be living in a state with a state income tax. Could be she would not be affected at all by the cap.

I take that as a yes, that you think she should be taxed. However she may not be taxed as you described. According to the IRS "The general rule regarding taxability of amounts received from settlement of lawsuits and other legal remedies is Internal Revenue Code (IRC) Section 61. This section states all income is taxable from whatever source derived, unless exempted by another section of the code. IRC Section 104 provides an exclusion from taxable income with respect to lawsuits, settlements and awards. However, the facts and circumstances surrounding each settlement payment must be considered to determine the purpose for which the money was received because not all amounts received from a settlement are exempt from taxes." Also the ultimate payer of these taxes isn't her. Donald Trump would be. So you didn't tax her at all ultimately.With the top tax bracket at 37% Fed Tax she is already down to $52.3 million. She also might be living in a state with a state income tax. Could be she would not be affected at all by the cap.

If it's taxed as income, it's income; hence the name "Income Tax". What is it about the numbers that don't add up? Perhaps your assumptions were just wrong.Something doesn't add up, if your numbers are right, and it is a fact (as we have agreed) that the rich got richer and the rest have stagnated.

I think it may have to do with what your source sees as "income":

I take that as a yes, that you think she should be taxed. However she may not be taxed as you described. According to the IRS "The general rule regarding taxability of amounts received from settlement of lawsuits and other legal remedies is Internal Revenue Code (IRC) Section 61. This section states all income is taxable from whatever source derived, unless exempted by another section of the code. IRC Section 104 provides an exclusion from taxable income with respect to lawsuits, settlements and awards. However, the facts and circumstances surrounding each settlement payment must be considered to determine the purpose for which the money was received because not all amounts received from a settlement are exempt from taxes." Also the ultimate payer of these taxes isn't her. Donald Trump would be. So you didn't tax her at all ultimately.

As a general rule, I am in favor of taxation. If you have been following this discussion then you know I do not favor a wealth cap, nor, I should specify, the implementation of a progressive tax much beyond were it is now, which means of course that I do not favor a 100% tax rate at any level of income.

I just thought it interesting that, if current income taxes applied to Ms. Carroll's award, she might not have been affected by the cap suggested by @PureX . Given the information you have provided, it seems the award may be exempt from income tax.

Heyo

Veteran Member

And if it's not taxed as income, it doesn't appear in your numbers. Perhaps your assumptions were wrong?If it's taxed as income, it's income; hence the name "Income Tax". What is it about the numbers that don't add up? Perhaps your assumptions were just wrong.

Remember that we are still investigating why the top 5% have 250% the income now than 50 years ago while the bottom 60% get still the same.

What kind of income is not taxed as income?And if it's not taxed as income, it doesn't appear in your numbers. Perhaps your assumptions were wrong?

Because it is much easier to get rich in todays economy and technology than it was yesteryear. Today 80% of our richest are first generation rich, few inherit their wealth. Yesteryear "old money" was common among the super rich; today the same old money exist, but because there is so much new money; old money seems rare. This allows those motivated and creative to get rich in ways never possible before.Remember that we are still investigating why the top 5% have 250% the income now than 50 years ago while the bottom 60% get still the same.

Heyo

Veteran Member

I cited your source.What kind of income is not taxed as income?

So, the environment has changed. Wouldn't it be good if our tax laws would adapt to the changes?Because it is much easier to get rich in todays economy and technology than it was yesteryear. Today 80% of our richest are first generation rich, few inherit their wealth. Yesteryear "old money" was common among the super rich; today the same old money exist, but because there is so much new money; old money seems rare. This allows those motivated and creative to get rich in ways never possible before.

Are you talking about tax credits? Or tax breaks?I cited your source.

In what ways has it not?So, the environment has changed. Wouldn't it be good if our tax laws would adapt to the changes?

Heyo

Veteran Member

In what ways has it not?

... while wealth and income for the majority stagnate or go down.Because it is much easier to get rich in todays economy and technology than it was yesteryear. Today 80% of our richest are first generation rich, few inherit their wealth.

This kind of inequality carries a lot of social explosives. It is seen as an indicator for unhappiness. You don't seem to see it as a problem at all. "Then let them eat cake" has led to revolutions.

RestlessSoul

Well-Known Member

What kind of income is not taxed as income?

Because it is much easier to get rich in todays economy and technology than it was yesteryear. Today 80% of our richest are first generation rich, few inherit their wealth. Yesteryear "old money" was common among the super rich; today the same old money exist, but because there is so much new money; old money seems rare. This allows those motivated and creative to get rich in ways never possible before.

Do you have any evidence to support these assertions?

I don't agree the income for the majority stagnate or goes down; todays middle income and poor are able to afford more luxuries, benefits, than ever before.... while wealth and income for the majority stagnate or go down.

This kind of inequality carries a lot of social explosives. It is seen as an indicator for unhappiness. You don't seem to see it as a problem at all. "Then let them eat cake" has led to revolutions.