I should've expected it.You're surprised that the government of a culture that values competition and wealth would be predatory????

Even governments which don't value competition & wealth are predatory too.

Welcome to Religious Forums, a friendly forum to discuss all religions in a friendly surrounding.

Your voice is missing! You will need to register to get access to the following site features:We hope to see you as a part of our community soon!

I should've expected it.You're surprised that the government of a culture that values competition and wealth would be predatory????

Yes, I do think taxpayers should be able to deduct losses from income, including losses exceeding income for future years, at least in regards to the tax code as its currently structured.Should taxpayers be able to deduct losses from their income?

Should losses exceeding income in the year incurred be allowed to be carried forward to future years?

I do not think capital losses should be deductible from ordinary income in the current system, because capital gains taxes are lower than taxes on ordinary income. At most, they should be able to deduct a proportional amount, for example, maybe half of capital losses should be deductable from ordinary income. However, I'm in favor of a simplified system with capital gains taxes, dividend taxes, and ordinary income all taxed at the same rate relative to the tax bracket that the person is in, which would easily allow capital losses to be deductible from ordinary income.Should capital losses be deductable from not just capital gains, but also ordinary income?

I need more info/context to answer that properly.Should taxpayers have to pay income tax on loans they've defaulted on? (Currently, they must.)

Not necessarily.You're wrong.

They're taxed upon their net income before they disburse any of it to shareholders.

And when the shareholders receive dividends, they pay tax on these.

It exists.

It results in a high rate of taxation on this kind of income.

With representation.Taxation....How To Do It?

Depreciation rates set by government are a poor measure reality.Yes, I do think taxpayers should be able to deduct losses from income, including losses exceeding income for future years, at least in regards to the tax code as its currently structured.

-If a person has two separate million dollar investments, and one of them doubles to $2 million and the other goes bankrupt to $0, their net gain was zero. They should be able to offset the positive income with the loss in that year.

-If a person loses a million dollars this year, but makes a million dollars next year, their net gain was zero over a two year period. So they shouldn't be taxed purely on the positive income.

The complexity arises, however, because even the very definition of "income" is complicated. For example, in real estate, a person can often deduct losses from depreciation. So the actual cash flow is sometimes far higher than the reported income. I've significantly benefited from this situation personally, with my investments in various REITs and MLPs. Especially for multi-millionaires and billionaires that derive the bulk of their income from this sort of arrangement, there are many ways to pay a lower effective tax rate than, say, a physician making $200k/year.

This is less true than before after Obama's 57% increase in capital gains taxes on real estate & stock investments.I do not think capital losses should be deductible from ordinary income in the current system, because capital gains taxes are lower than taxes on ordinary income.

The simple & fair thing to do is to make no distinction between different types of income, but to adjust for inflation when time is a factor.At most, they should be able to deduct a proportional amount, for example, maybe half of capital losses should be deductable from ordinary income. However, I'm in favor of a simplified system with capital gains taxes, dividend taxes, and ordinary income all taxed at the same rate relative to the tax bracket that the person is in, which would easily allow capital losses to be deductible from ordinary income.

I need more info/context to answer that properly.

-

Your analysis doesn't appear to take into account the difference between average personal income tax rates & marginal personal income tax rates.Not necessarily.

The average American corporation pays an effective federal tax rate of about 12.6%, according to the Government Accountability Office. That's despite the 35% official rate.

http://money.cnn.com/2013/07/01/news/economy/corporate-tax-rate/

Then, dividend taxes are only 20% for the highest tax bracket.

http://www.schwab.com/public/schwab/nn/articles/Taxes-Whats-New

So say you have a simplified corporate example, where the company makes $1 million in taxable income. They pay, let's be generous and say 15% to the federal government, leaving them with $850,000 in net income. Then of that $850,000, they keep about half to two thirds for growing the company, and pay $300,000 in dividends to shareholders. If you look up corporations, that's a fairly typical split.

So, $300,00 is sent out to shareholders, and they pay perhaps 20% that income in federal tax, which comes out to $60,000.

All in all, $1 million was made that year, but only $210,000 in taxes were paid ($150,000+$60,000). An effective tax rate of only 21%. Many middle class and upper middle class Americans are paying a lot more than that.

The real-world example gets a lot more complex, because both workers and corporations are paying payroll taxes, and middle-income workers have tax shelters like 401ks and IRAs and so forth, billionaires have other tax loopholes to exploit that they've successfully lobbied for, and that remaining $550k (the corporate net income not spent on dividends) will be somewhat eventually taxed to shareholders as capital gains. But the basic math of a fairly standard corporate example above gives wealthy shareholders quite a modest rate overall.

You're so old fashioned!With representation.

That's all I know.

Want to see true old fashioned? Go here.You're so old fashioned!

The argument over Trumps big loss a couple decades ago

involves some assumptions which aren't being addressed.

This thread isn't about Pubs v Dems or Trump v Hillary or the election.

Those topics may come up, but should remain incidental.

It's about Americastanian taxation in general.

Some questions......

Should taxpayers be able to deduct losses from their income?

Should capital losses be deductable from not just capital gains, but also ordinary income?

Should losses exceeding income in the year incurred be allowed to be carried forward to future years?

Should taxpayers have to pay income tax on loans they've defaulted on? (Currently, they must.)

Despite the fact that he increased them, dividend tax rates and capital tax rates on stocks, real estate, etc. are still lower than several of the ordinary income tax brackets.This is less true than before after Obama's 57% increase in capital gains taxes on real estate & stock investments.

1) I agree it would be fair to adjust for inflation in capital gains taxes. It would make things slightly more complicated, however. Fiscal conservatives usually aren't in favor of increasing tax complexity.Other classes of capital gains are taxed at the full income tax rate, eg, collectibles.

In reality, capital gains are tax at far higher economic rates than income.

Consider.....

Income is taxed in the year received, so the effects of inflation are de minimis.

But capital gains are calculated without deducting loss the value of money.

Hypothetical illustration.....

Ignore depreciation deductions & capital improvements for simplicity.

You buy a property in 2000 for $1,000,000.

You sell it in 2010 for $2,000,000

Assume 7% inflation (ie, money loses 7% of value per year).

$2,000,000 in 2010 dollars is only worth $1,000,000 in 2000 dollars.

So there is no economic profit on the sale.

It just took twice as many dollars to get back one's original investment value.

The simple & fair thing to do is to make no distinction between different types of income, but to adjust for inflation when time is a factor.

It does take into account marginal tax rates indirectly, because I was specifically mentioning middle class and upper middle class folks in my post.Your analysis doesn't appear to take into account the difference between average personal income tax rates & marginal personal income tax rates.

My post specifically mentioned that any of the corporate income not paid in dividends went generally towards growing the company.Also, corporate income which is held is typically used for investment in the business.

(They cannot sit on untaxed cash.) This is a good thing for the economy.

No, things would be less complex under my proposal.1) I agree it would be fair to adjust for inflation in capital gains taxes. It would make things slightly more complicated, however. Fiscal conservatives usually aren't in favor of increasing tax complexity.

Huh?2) Dividend taxes are paid for the year they are received, so your point doesn't apply to them.

Of course it's applicable.3) Your hypothetical example is true, but not currently applicable. The inflation rate is far lower than 7%. So it's about possible futures or about times decades past.

We should not base public policy upon what "usually" happens.4) Real estate usually benefits from inflation, if they arrange it right.

This is not always true.If they get a fixed mortgage or fixed debt of some kind to pay for 70% or so of the property, they do massively well when the property's price escalates from inflation, especially if they're also renting it out the whole time or using it for whatever purpose they wanted.

To have turned $300,000 into $500,000 is a way of looking at cash flow,Consider, for example, you buy that million dollar property in 2000, as per year your example.

Except you only put $300,000 down, and a bank puts the other $700,000 in.

In 2010, you sell it for $2,000,000, and pay the bank back their $700,000, plus lets say $100,000 in interest on that debt.

So you invested $300,000, and now have $1,200,000 ($2,000,000 minus the bank's $800,000 that you paid back).

You quadrupled your investment in ten years.

Then you pay, say, 20% capital gains on that property, so you pay $200,000, since your gain was $1,000,000.

So, after taxes, you turned $300,000 into $1,000,000 in ten years. And when adjusted for inflation, it would have turned $300,000 into $500,000, which is pretty good for an inflation-adjusted rate of return. But then most likely, you also derived rent income or something from that property for those ten years. So the actual rate of return would be even higher.

Hmmmm....I begin to suspect that the IRS is predatory.

Whoodathunkit?

No, I even agreed that adjusting capital gains for inflation would be acceptable. It's a reasonable policy, especially if everything else is simplified enough.No, things would be less complex under my proposal.

To introduce inflation calculations is uber simple.

The current complexity of the code isn't in having to do a few simple calculations or referring to tables.

It's in the voluminous byzantine & often unclear rules.

Huh?

Which point?

Dividends are of course ordinary income, generated in the immediate tax year.

Of course it's applicable.

Note that I made specific simplifying assumptions for the sole purpose of illustrating how inflation works.

It's well known by many that 10 years compounding at 7% (like 7 years at 10%) is approximately a factor of 2

Had I used real inflation rates, they'd have varied each year, complicating my point that

we're taxed on the loss of value of the dollar when we sell assets at a nominal profit.

We should not base public policy upon what "usually" happens.

What I propose addresses the general case, ie, properties could go up or down in value.

This is not always true.

Properties in Atlantic City, Detroit & many other places are seeing massive losses.

And commercial loans are typically variable rate & require regular renewal.

Again, it's bad to design public policy based upon the false assumption that everyone always makes a profit.

To have turned $300,000 into $500,000 is a way of looking at cash flow,

but this is not how net income is calculated, either by GAAP, the IRS, or

by my proposed system.

You painted a very rosy picture. Perhaps this is intended to justify taxing

the phantom gains of devalued currency over time. I oppose that.

It's true that I didn't address that.You didn't address the practical fact that the top 1% (which make much of their income from dividends and capital gains from equities, real estate, and similar investments) under the current and former tax system have gained virtually all of the income and wealth gains over the last few decades, and income inequality keeps rising.

Not for the antiques I handle.Capital gains taxes are lower than ordinary working income taxes.

I didn't get into the relationship between average rates, marginal rates, & investment decisions yet.Dividend taxes are lower than ordinary working income taxes. Corporate tax is effectively 12.6% in practice on average. Money made from money is more scalable and exponential than money made from labor to begin with. You didn't comment on those points. You agreed depreciation could use an overhaul. And then there is carried interest, offshore tax havens, and other legal cheats.

Some more specifics......I've even said that I've benefited from tax loopholes that wealthy people often use. My MLPs and REITs pay pretty low effective tax rates. The taxable income they report is far lower than their actual cash flow, often over a period of decades, and I get to defer MLP distribution taxes for a while and compound my returns, leading to very high rates of return. It's all common and simple- Turbotax and H&R Block know how to do it. If I was making $1 million a year from this, I'd be paying a far lower tax rate than my doctor who makes maybe $200k a year. Clearly a messed up system.

Which is why I favor taxing most or all types of income at the same rate in any given tax bracket, up to the current max of 40% or so, and reducing the number of loopholes. I'm also in favor lowing the corporate tax rate to about 15% and reducing loopholes.

In the context of my post, when I referred to capital gains taxes being lower than ordinary income taxes, I was referring to equities and other primary investing assets. I was talking about that in the context of billionaires, capital gains, dividends, corporate tax, etc.It's true that I didn't address that.

All things in due course.

I favor a progressive income tax, letting the rate be determined by amount of income rather than the source.

Not for the antiques I handle.

As "collectibles", they're taxed at the same rate as ordinary investment income.

And as I pointed out, the effective economic rate is far higher because I'm paid

in today's dollars instead of those I spent decades ago.

I'm all for streamlining the tax code.I didn't get into the relationship between average rates, marginal rates, & investment decisions yet.

Some more specifics......

- I'd eliminate the SS & self-employment taxes by rolling them into the income tax.

This would give employment & investment incomes the same rate, which could

then be lower for a given level of revenue,

- I'd eliminate personal deductions, but raise the threshold below which there's no tax.

This would allow lower marginal rates, thereby incentivizing producing income.

- When I become dictator, I'll begin a thorough review of the whole shoot'n match.

I'll be back to a computer in a week.In the context of my post, when I referred to capital gains taxes being lower than ordinary income taxes, I was referring to equities and other primary investing assets. I was talking about that in the context of billionaires, capital gains, dividends, corporate tax, etc.

There aren't a whole lot of antiques collectors out there making billions of dollars from what they do; only a tiny fraction of all capital gains taxes paid are from collectibles. In fact, that's probably why their tax rate is terrible- they didn't collectively make enough money to lobby on behalf of themselves and get politicians firmly in their corner to produce an advantaged tax status for them.

I'm all for streamlining the tax code.

Eliminating or reducing deductions, raising the threshold of the 0% tax bracket, taxing most or all types of income the same relative to each other with progressive brackets, and lowering the rates a bit overall are things I would support if the numbers were right.

I'd also support a much lower 10-15% corporate tax without deductions.

sorry to be soooooo late....but is it true?The argument over Trumps big loss a couple decades ago

involves some assumptions which aren't being addressed.

This thread isn't about Pubs v Dems or Trump v Hillary or the election.

Those topics may come up, but should remain incidental.

It's about Americastanian taxation in general.

Some questions......

Should taxpayers be able to deduct losses from their income?

Should capital losses be deductable from not just capital gains, but also ordinary income?

Should losses exceeding income in the year incurred be allowed to be carried forward to future years?

Should taxpayers have to pay income tax on loans they've defaulted on? (Currently, they must.)

sorry to be soooooo late....but is it true?

I heard a report that FDR dealt a tax of 100% for all income over 25,000dollars

a more recent report (10yrs? ago)My father bought his first house, pretty decent house and nice neighborhood, for 4k, Like most people, when 25k was a lot of money, many people were open to confiscating it for 'the greater good'- it's one of the oldest political tricks in the book, 'hey let's tax those rich b***ards'.. but then fail to index the tax brackets to inflation... not a nice thing to vote for, for your kids

a more recent report (10yrs? ago)

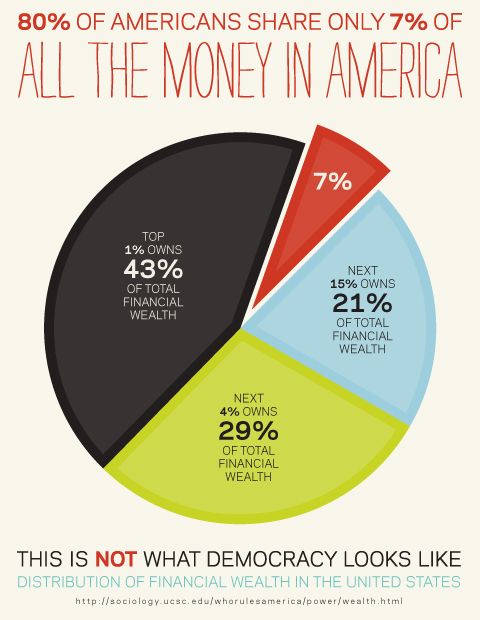

in 1985 5% of the nation held 8trillion dollars of personal holdings

in 2005 5% of the nation held 40trillion dollars of personal holdings

not sure if my recall is sharp

but that report stunned me

as the majority move to a struggle of check to check living.....

some have multiplied their wealth 5fold

I think that same event brought this country to a severe depression in the previous century

and that is what FDR was trying to correct

story goes....

FDR pointed a finger at the wealthy and told them....

you did this ....you will fix it

hence the economic maneuver I mentioned previous