Something Big like confirmation that the Trump administration has been issuing phony economic numbers.

Retail establishments are closing at record levels.

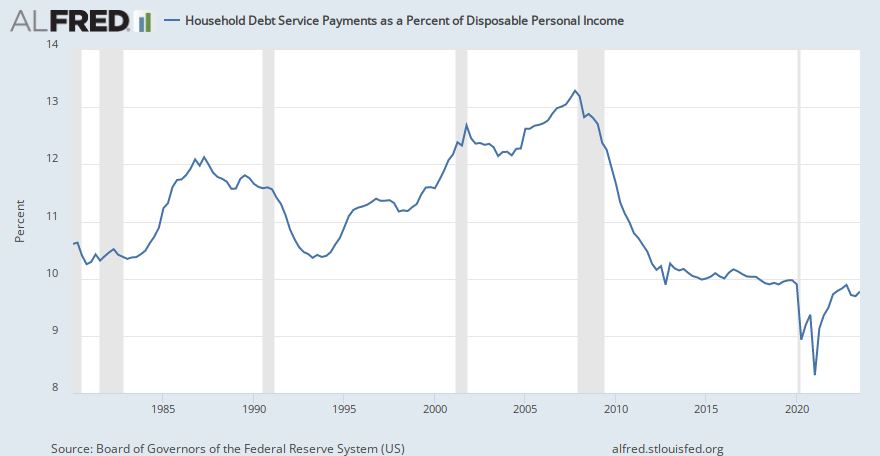

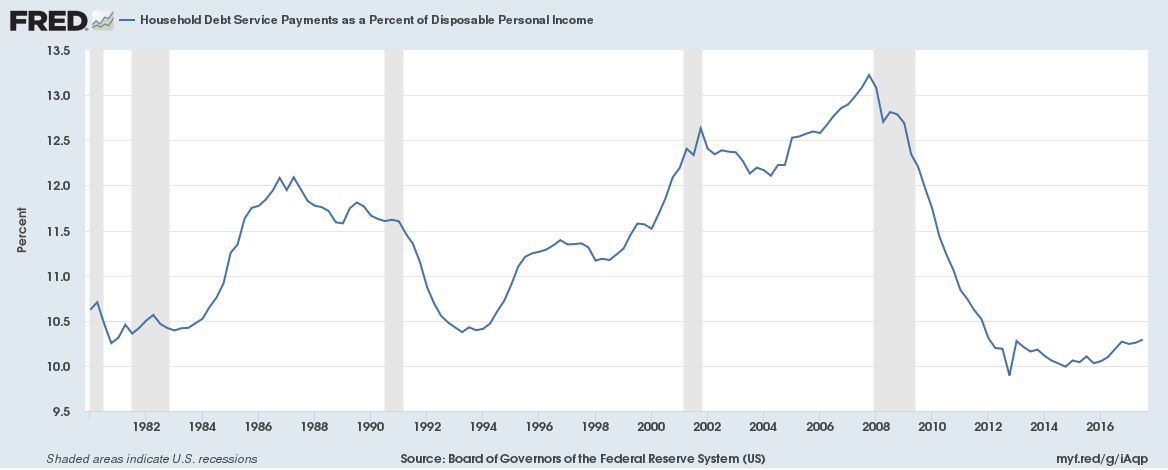

Consumer debt is at an all-time high.

Google: current consumer credit card debt

More than 189 million Americans have credit cards. The average credit card holder has at least four cards. On average, each household with a credit card carries $8,398 in credit card debt. Total U.S. consumer debt is at $13.86 trillion.

Yet we hear glowing reports like:

Total nonfarm payroll employment rose by 225,000 in January, and the unemployment rate was little changed at 3.6 percent, the U.S. Bureau of Labor Statistics reported today.

If things are so great, why are more Americans in more debt than ever before?