It is funny, I just cannot say, "Math" without thinking 'That is so wrong'

And I'm the same way with 'maths'. It just *feels wrong*.

Welcome to Religious Forums, a friendly forum to discuss all religions in a friendly surrounding.

Your voice is missing! You will need to register to get access to the following site features:We hope to see you as a part of our community soon!

It is funny, I just cannot say, "Math" without thinking 'That is so wrong'

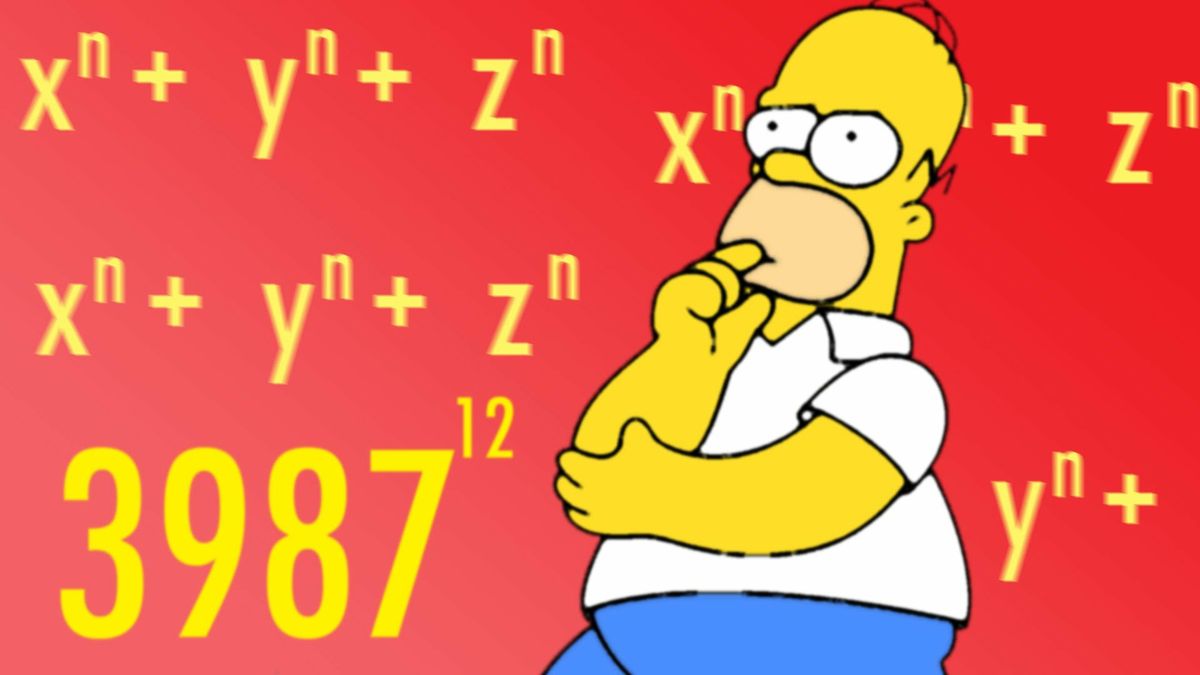

Speaking of math ignorance. He should be brilliant at math. Given his background of employment and all involving nuclear physics.Fun on a bun!

I suppose that I must be the only person who does not understand why you would send in 5.66% (of $50,000) when the rate is 6% (of $50,000) .For some of the sales (about $50K), they charged no sales tax. My friend wondered if he should let the error slide, or send 6%

(Michigan's rate) to the state. It's enuf to advise paying the state.

I explained that it would be 5.66% rather than 6%. I explained the

basic algebra over the phone, but could still see in his eyes that

deer-in-the-headlights look. So I did it for him on paper, & sent

him a photo.

Use ratios .. Solve 50/53 (6%) equals n/50 and get 47.169 .. which is 5.66%. There would be other was to demonstrate.I suppose that I must be the only person who does not understand why you would send in 5.66% (of $50,000) when the rate is 6% (of $50,000) .

Most people don't, and they certainly don't want pennies. I don't even bother counting it all out when people give me a heap of random coins. I just hit "exact change" on the register. I don't want to touch their stuff, anyway.And who needs the correct change anyway!? Come on, it's not as though anyone counts it

Sometimes people are hurried or distracted,Maths is hard, really hard. It just isn't for everyone.

I did some tutoring as a student and I could help most pupils but some just aren't able to think abstract.

Fractions are crucial for maths. Many get through it with some luck and it hits them when they have to do quadratic equations. Then they came to me because they thought they didn't understand quadratic equations.

(A recurring pattern. Most YEC think there's a problem with evolutionary biology when in reality they have a problem with science in general.)

I once had to explain to my bosses (one of them had a maths degree) why the sum of discounted items isn't always the discounted sum of the items.

You would think so, but Homer was a tech and a safety inspector at a power plant, not a nuclear physicist, lol. He was also hired as part of a program to bring in unskilled workers. So we actually shouldn't expect him to be good at math . LolSpeaking of math ignorance. He should be brilliant at math. Given his background of employment and all involving nuclear physics.

But then again I know a millionaire CPA and investor, and he does not know the order of operations (he definitely road the family coattails because he's not actually that bright).

His position as a tech would have had him needing a background in nuclear physics and engineering. He would have had a math-intensive course load in college. But yet I'm not sure if Homer would even know the most basic of engineering formulae.You would think so, but Homer was a tech and a safety inspector at a power plant, not a nuclear physicist,

Go with what we know, & make some substitutions.....I suppose that I must be the only person who does not understand why you would send in 5.66% (of $50,000) when the rate is 6% (of $50,000) .

I suppose that I must be the only person who does not understand why you would send in 5.66% (of $50,000) when the rate is 6% (of $50,000) .

Yep. In our modern times people are pretty much detached from the reality of life. Who needs to use trigonometry to construct something? I don't remember all the formulae, I just know how to construct them.Sometimes people are hurried or distracted,

& forget to apply the math they've learned.

He had a sale on lumber

over the weekend, & did a bang up business. Alas, his office

manager was out sick, & a little snafu happened. For some of

the sales (about $50K), they charged no sales tax.

Go with what we know, & make some substitutions.....

Payment = money received

Price + Tax = Payment

Price + (.06 x Price) = Payment

Price x (.06 + 1) = Payment

Price = Payment / 1.06

Tax = .06 x Price

Tax = .06 x (Payment / 1.06)

Tax = Payment x .06/1.06

Tax = 5.66% of Payment

Think of it like this. If you had $50,000 and needed to pay 6% of it, that would be $3000. So, if you had a total of $53,000=$50,000*(1.06), you would need to pay $3000 of it.

But, if you only have $50,000, how much should you pay? Certainly NOT $3000, since then you would have $47000 left and 6% of that is not that $3000.

They're required by law to charge sales tax.Uh, what?

From the original post, they "charged no sales tax" - sales tax paid = 0.

If they paid $50,000 then that was the price for the lumber $50,000 plus the tax charged $0.

The transaction should have been...

Lumber $50,000

Tax (6%) $3,000

================

$53,000

The transaction was...

Lumber $50,000

Tax (uncollected) $0

================

$50,000

The purchaser actually paid only $50,000 for $50,000 worth of lumber. The company owes 6% of $50,000 [$3,000] to the state.

From your post:

Payment = money received

Price + Tax = Payment

Price + (.06 x Price) = Payment

Correct Version

Payment = money received

Price + Tax = Payment (IF the salesman did it correctly - he didn't)

Therefore...

Price (50,000) + Tax (0) = payment (50,000)

I'm open to being shown what I'm doing wrong.

Please see next post also.

It's the 21st Century. Maybe your friend needs a good POS system. Actually, I find it hard to believe that any company that can make a single $50,000 sale for lumber doesn't have an automated POS system.A friend called today for some advice. He had a sale on lumber

over the weekend, & did a bang up business. Alas, his office

manager was out sick, & a little snafu happened. For some of

the sales (about $50K), they charged no sales tax.

It was a hugely popular sale attended by many more thanIt's the 21st Century. Maybe your friend needs a good POS system. Actually, I find it hard to believe that any company that can make a single $50,000 sale for lumber doesn't have an automated POS system.

That's not what your OP post stated:They're required by law to charge sales tax.

If not added to the price, then it's imputed,

ie, included in the price.

We'll agree to disagree.That's not what your OP post stated:

For some of the sales (about $50K), they charged no sales tax.

"some of the sales" $50,000 worth of lumber.

"charged no sales tax" sales tax charged: $0

"They're required by law to charge sales tax"

I think the actual requirement is that the company must pay 6% of sales on taxable items to the State.

The state is not going to go after the clerk for not charging the 6%.

The state will go after the company for not paying the 6% ($3,000).

Consider:

This sale $50,000

Other sales this month $950,000

Tax charged and collected on the bad $50,000 sale = $0

Tax charged and collected on correct sales during the month 6% of $950,000 = $57,000

Paperwork submitted to state at end of month.

Sales: $1,000,000

Taxes owed at 6%: $60,000

Your friend collected only $57,000. He owes $60,000.

Realistically, he should have immediately contacted the buyer and explained the problem. If he didn't want to do that, he is stuck for the $3,000.

Yeah. Started and ran successfully for over 20 years.Ever start a new business?