First off, for this response I'm assuming your stats are correct. That said..

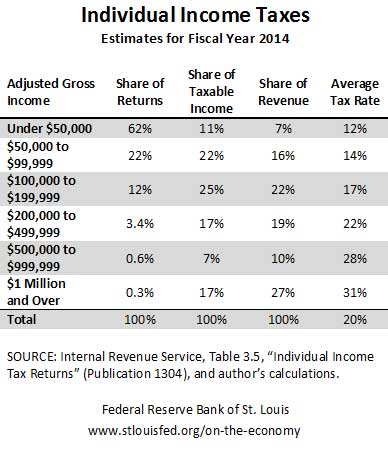

First off, where do the remaining 56% of the taxes come from? The $50k-$500k folks correct? And presumably that group is 37% of the total number of returns?

Second, your last sentence is ambiguous. You mean per capita? you mean as a group? Are we to guess that your definition of "lower income" stops at 50k?

Next, if we assume some sort of baseline, minimum livable salary that should be tax exempt, wouldn't that change the numbers quite a bit? For a number of the lower income folks, the taxes they pay probably tip them to below some decent minimums, which is not the case for the rest of taxpayers.

Next, shouldn't we factor in income and wealth inequities? Do you think a low income person with no assets to speak of should be treated the same way as people with significant financial assets?