dust1n

Zindīq

The House Ways and Means committee is beginning to debate whether to let the Bush-era tax cuts for the wealthy expire at the end of this year.

There will be the usual carping about how this would hurt the economy, punish the successful, kill the geese that lay the golden eggs. But some of the geese think it’s a good idea.

It’s not surprising that 60 percent of all Americans support raising taxes on households with incomes over $250,000, according Quinnipiac University poll.

What’s curious is some of the people who will pay these higher taxes also agree. The Quinnipiac poll reveals that 64 percent of those with incomes over $250,000 support the tax hike. This is echoed by the unusual voices of retired CEOs, current business leaders and small business owners, many of them affiliated with Wealth for the Common Good, a network concerned about tax fairness that I co-founded.

They don’t sound like they’re fomenting class warfare. If anything, they are waxing poetic and patriotic.

“I hope Congress has the courage to let my tax cut expire,” wrote Gene Mulligan, an investment manager from Alexandria, Va., in a syndicated column. “Our nation has built a remarkable marketplace for enterprise and wealth creation. Taxes paid for the public investments in research, education, infrastructure and technology that made this possible. They paid for law enforcement and orderly marketplaces. These public investments buoyed my personal opportunities and wealth. I am certain they have done the same for millions of other Americans.”

Arul Menezes, a principal architect at Microsoft, wrote in an op-ed for that was published in The Cleveland Plain Dealer that the meritocratic system and infrastructure that made his entrepreneurial success possible is eroding. “Our investment as citizens in our collective “commons” lays the foundation for our individual wealth and success. Taxes are the price we pay to live in a civilized and healthy society. Those of us who have disproportionately benefited from public investments have a responsibility to pay back our society so that others can have similar opportunities.”

...

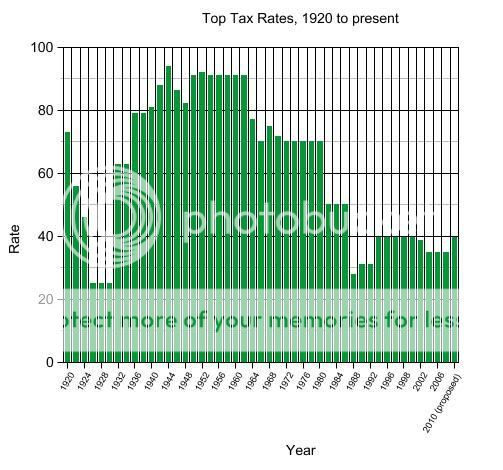

According to a new report from Wealth for the Common Good, Shifting Responsibility, the wealthy have received massive tax cuts not just under President George W. Bush, but for decades before. Since 1960, the share of household income that middle class households paid in federal taxes has increased slightly, from 15.9 to 16.1 percent. But America’s wealthiest taxpayers have seen their tax outlays, as a share of income, drop by almost half. The top 1 percent of taxpayers, those with incomes starting at $2 million, saw the share of income paid in federal taxes decline from 60 to 33.6 percent between 1960 and 2004.

During President Bush’s eight years in office, Congress expanded tax cuts to Americans with incomes over $250,000. We had to add another $700 billion to the national debt to cover them.

New Voices for Taxing the Wealthy « SpeakEasy

Do you think Congress has the cojenas to make it happen?

There will be the usual carping about how this would hurt the economy, punish the successful, kill the geese that lay the golden eggs. But some of the geese think it’s a good idea.

It’s not surprising that 60 percent of all Americans support raising taxes on households with incomes over $250,000, according Quinnipiac University poll.

What’s curious is some of the people who will pay these higher taxes also agree. The Quinnipiac poll reveals that 64 percent of those with incomes over $250,000 support the tax hike. This is echoed by the unusual voices of retired CEOs, current business leaders and small business owners, many of them affiliated with Wealth for the Common Good, a network concerned about tax fairness that I co-founded.

They don’t sound like they’re fomenting class warfare. If anything, they are waxing poetic and patriotic.

“I hope Congress has the courage to let my tax cut expire,” wrote Gene Mulligan, an investment manager from Alexandria, Va., in a syndicated column. “Our nation has built a remarkable marketplace for enterprise and wealth creation. Taxes paid for the public investments in research, education, infrastructure and technology that made this possible. They paid for law enforcement and orderly marketplaces. These public investments buoyed my personal opportunities and wealth. I am certain they have done the same for millions of other Americans.”

Arul Menezes, a principal architect at Microsoft, wrote in an op-ed for that was published in The Cleveland Plain Dealer that the meritocratic system and infrastructure that made his entrepreneurial success possible is eroding. “Our investment as citizens in our collective “commons” lays the foundation for our individual wealth and success. Taxes are the price we pay to live in a civilized and healthy society. Those of us who have disproportionately benefited from public investments have a responsibility to pay back our society so that others can have similar opportunities.”

...

According to a new report from Wealth for the Common Good, Shifting Responsibility, the wealthy have received massive tax cuts not just under President George W. Bush, but for decades before. Since 1960, the share of household income that middle class households paid in federal taxes has increased slightly, from 15.9 to 16.1 percent. But America’s wealthiest taxpayers have seen their tax outlays, as a share of income, drop by almost half. The top 1 percent of taxpayers, those with incomes starting at $2 million, saw the share of income paid in federal taxes decline from 60 to 33.6 percent between 1960 and 2004.

During President Bush’s eight years in office, Congress expanded tax cuts to Americans with incomes over $250,000. We had to add another $700 billion to the national debt to cover them.

New Voices for Taxing the Wealthy « SpeakEasy

Do you think Congress has the cojenas to make it happen?